Sales shifts to 360° enterprise thinking

Thomson Reuters Financial & Risk

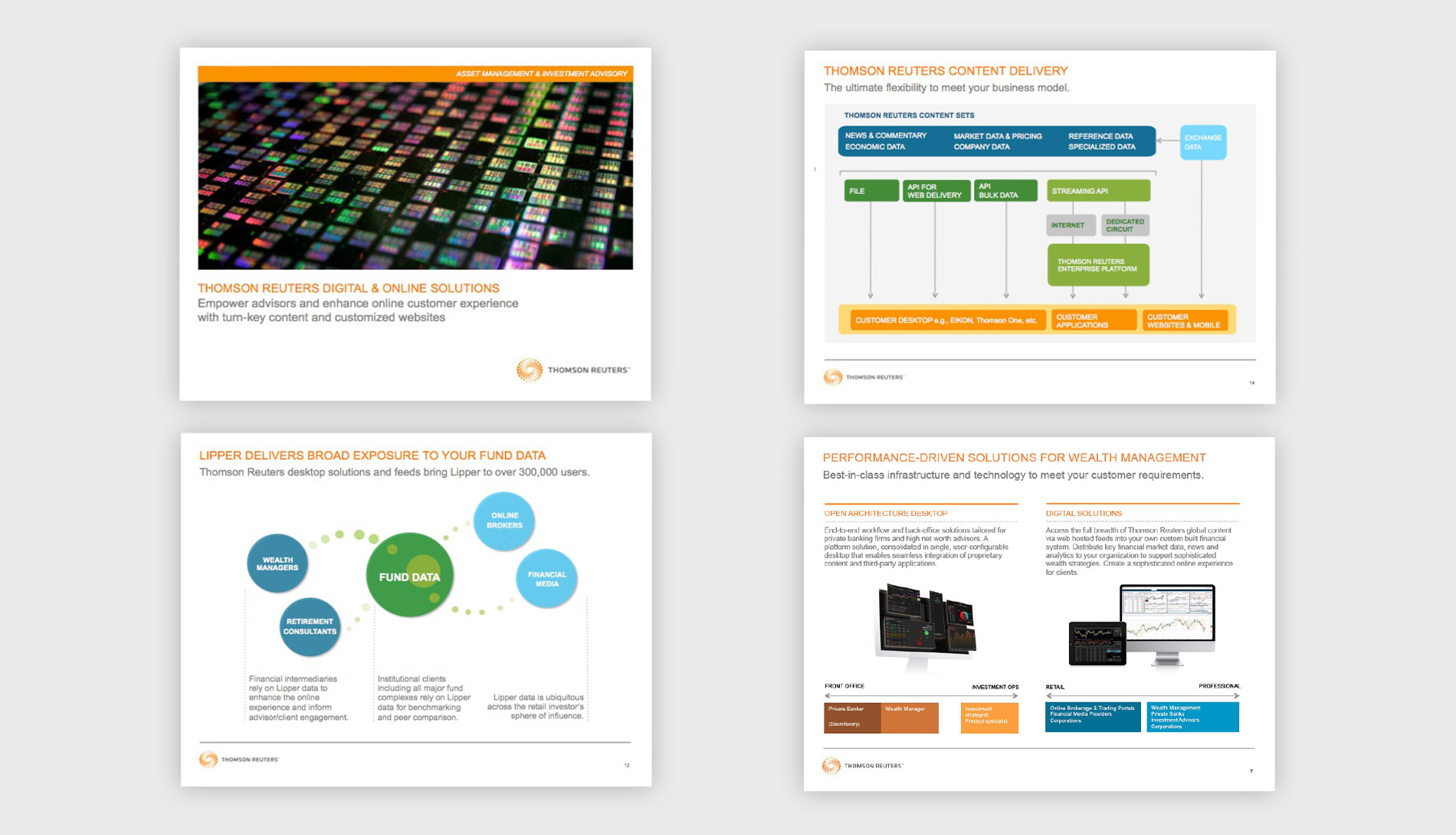

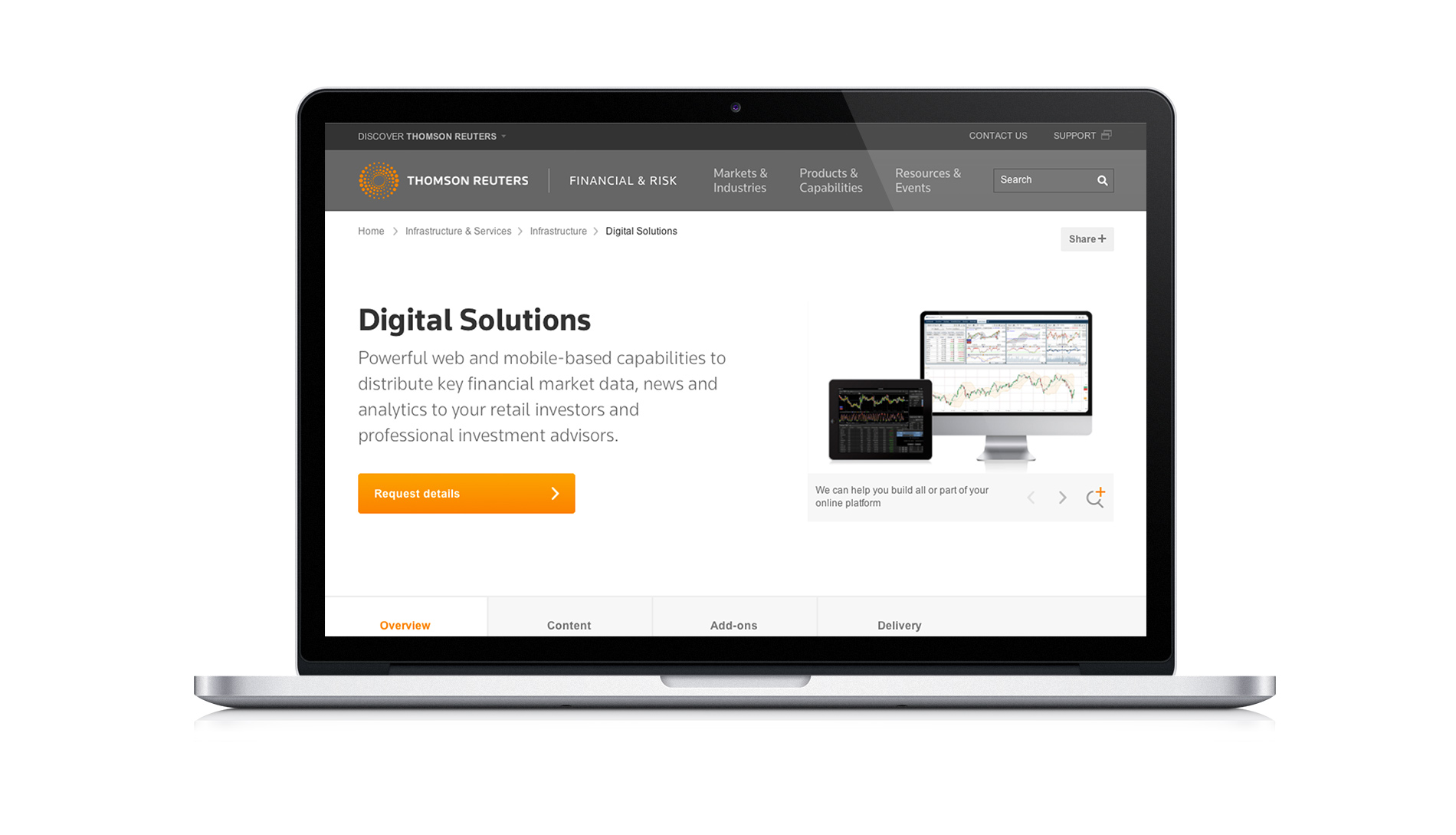

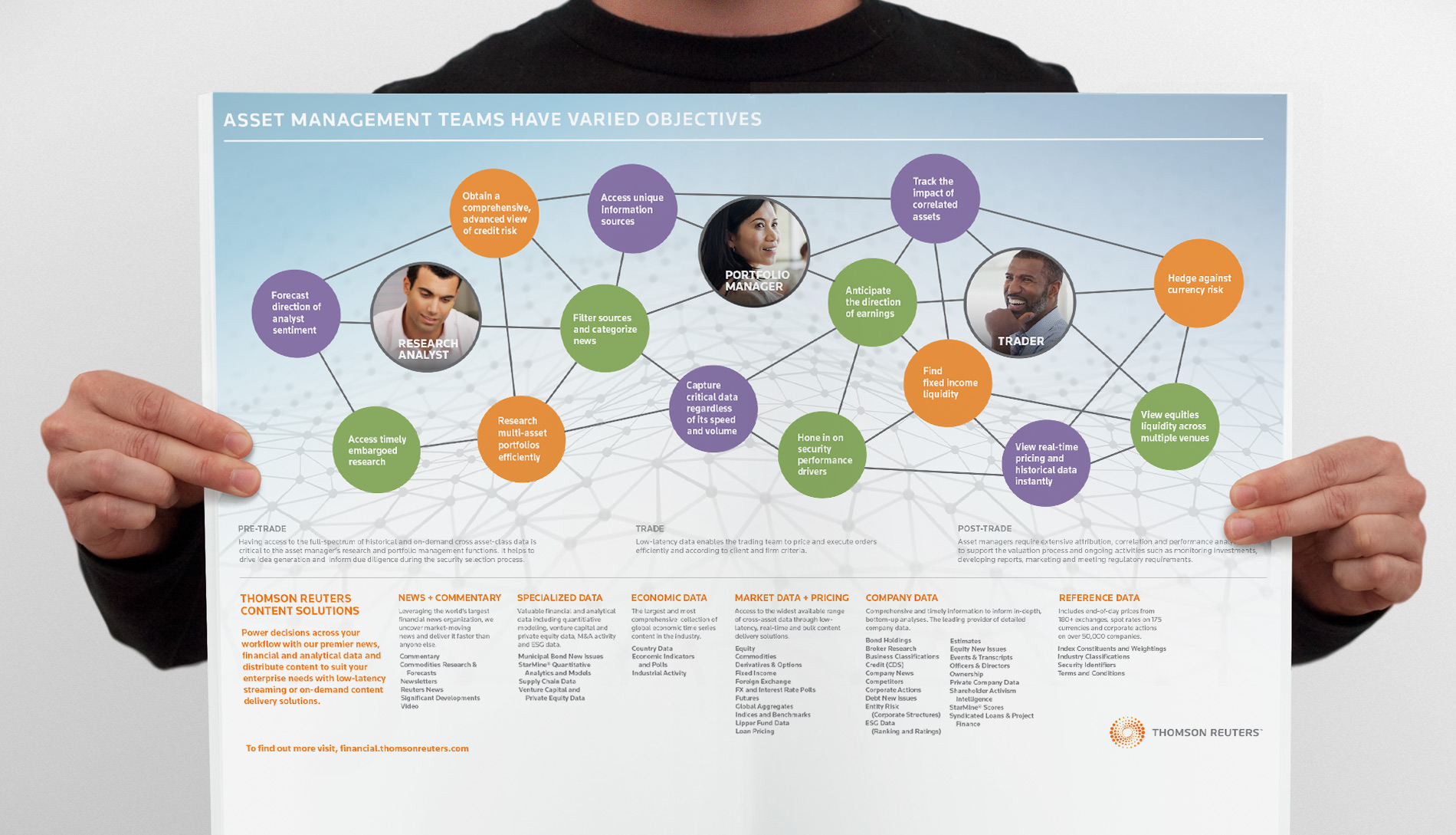

Strategic sales enablement to demonstrate affinity with market segments

Challenge

Thomson Reuters Financial & Risk served more than 40,000 businesses in over 150 countries. With a vast and technical array of offerings, its channels and audiences morphed and evolved continually as new businesses were acquired and new products launched. Messaging centered on technical features and the strategy for promoting thousands of branded products and services became highly fragmented, with inconsistent value propositions across audiences.

Thomson Reuters needed to move away from product-pushing to an enterprise approach that packaged its solutions in ways that made sense for its audiences’ business needs. This called for a marketing strategy that could be segmented to audiences such as asset managers, alternatives managers, asset owners and trading firms. In addition, Thomson Reuters needed messaging that clearly expressed the benefits of its solutions for specific functions and roles in the firms.

Solution

Over the course of three years, we transformed Thomson Reuters’ Financial & Risk sales enablement, creating a unified content strategy and value proposition for its aptly named “360° Platform.” We also produced a coordinated segment-based selling system to support the efforts of a widely distributed field force. This included the marketing of high-visibility integrations such as the REDI Execution Management System and the Eikon desktop. In 2018, a Blackstone consortium acquired a majority stake in Thomson Reuters Financial & Risk, renaming it Refinitiv and selling it the following year to London Stock Exchange Group.